Client Lifecycle Management

The enterprise capability that keeps a bank’s client relationships valid, controlled, and executable over time.

Client Lifecycle Management (CLM) is how a bank ensures it always knows who it is dealing with, what it is allowed to do with them, and when that must change — across products, jurisdictions, and time.

Client Lifecycle Management is the enterprise capability that maintains the validity, scope, and permissions of the bank’s client relationships over time, enabling all core banking activities to operate safely, consistently, and at scale.

Why Client Lifecycle Management is needed

Many bank control structures — particularly in KYC — are organised around the legal entity as the primary unit of analysis. This has been appropriate for identity verification, legal accountability, and regulatory reporting.

However, the client relationship the bank actually manages is often broader: a collection of legal entities linked by ownership, control, mandate, or economic purpose, and interacting with the bank across multiple products and jurisdictions over time.

While individual controls operate effectively at legal-entity level, there is often no single capability responsible for maintaining the validity, scope, and permissions of the relationship as a whole as it evolves.

Client Lifecycle Management is needed to bridge this gap — by managing the lifecycle of client relationships, not just individual legal entities, and providing a consistent foundation for downstream activity

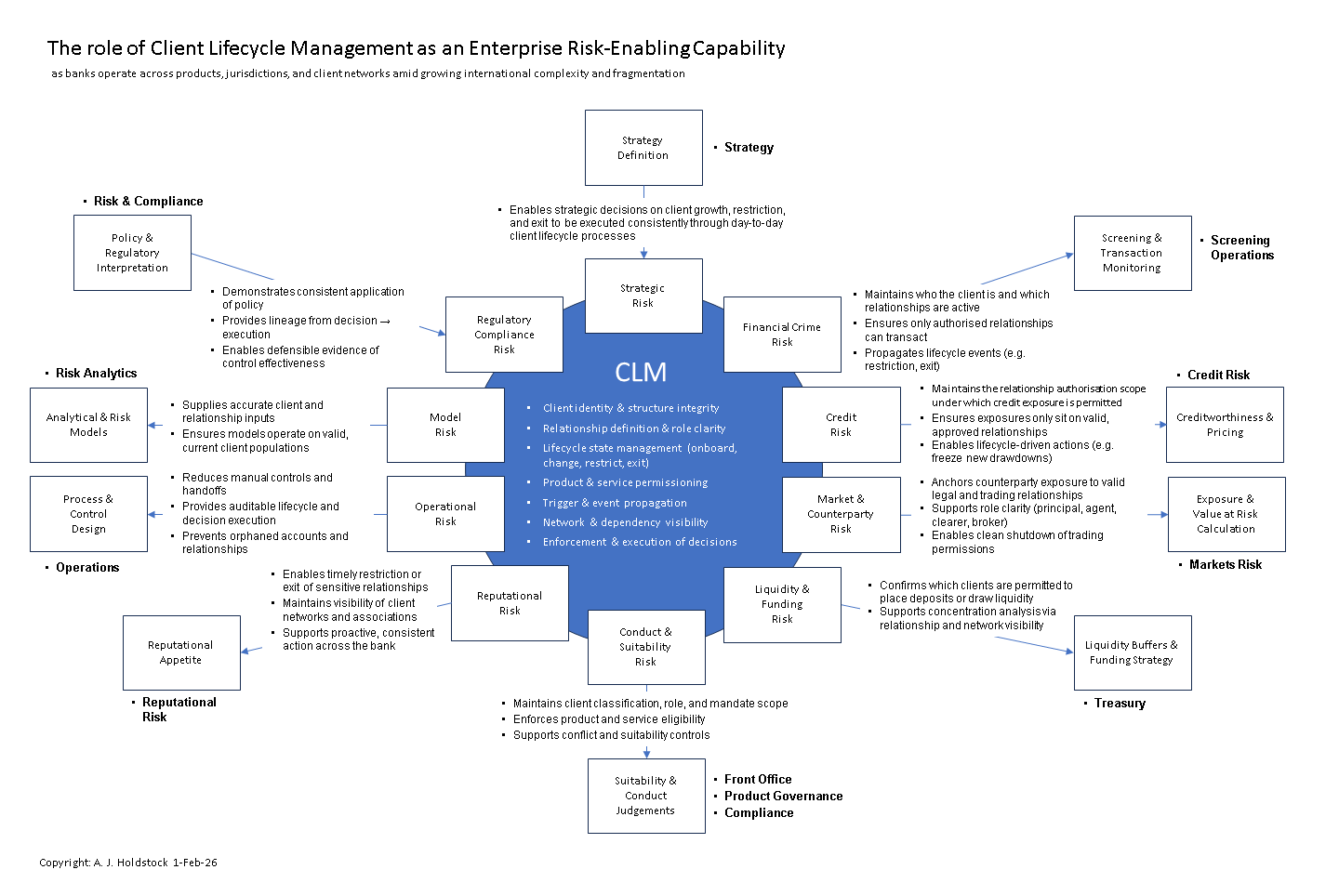

CLM as an enterprise risk-enabling capability

CLM sits at the centre of the bank’s risk and execution model, maintaining the integrity of client relationships and enabling other functions to operate on a trusted, current foundation.

CLM does not assess risk — it ensures that risk decisions can be executed consistently, defensibly, and at scale.

What CLM controls

CLM is responsible for:

Client identity and structural integrity

Relationship definition and role clarity

Lifecycle state management (onboard, change, restrict, exit)

Product and service permissioning

Trigger and event propagation

Network and dependency visibility

Enforcement of lifecycle and risk decisions

Why CLM has become critical

Historically, banks could operate without a coherent CLM capability because complexity was lower and control gaps were tolerable.

That is no longer the case.

International fragmentation, heightened geopolitical sensitivity, networked client risk, and regulatory expectations have made relationship control as important as transaction control.

CLM is the missing capability that allows banks to operate safely in this environment.

How to use this site

Client Network Risk Management (CNRM)

Understanding risk across interconnected client structures and networksEntity–Role–Relationship (ERR)

A structural model for representing clients, roles, and business arrangements coherentlyEnterprise Client Lifecycle Management (E-CLM)

CLM understood and governed as an enterprise capability, not a functionOperating Model Engineering

Designing operating models for performance, stability, and changeTOM → Feature Pathway

Connecting intent, design, and implementation.

Context

This site reflects practical experience designing and operating CLM capabilities in large, international banks — grounded in real transformation constraints, regulatory expectations, and operational reality.